5 Best Accounting Software For Small Law Firms (A 2026 Guide)

5 Best Accounting Software For Small Law Firms (A 2026 Guide)

Keeping a small law firm financially stable takes more than just landing new clients.

Late payments, trust accounting mistakes, and disorganized records can lead to compliance issues and cash flow problems. Without the right system, even simple bookkeeping tasks can turn into unnecessary headaches.

That’s why many firms turn to legal accounting software. Instead of juggling spreadsheets or using a generic accounting tool that doesn’t fit your needs, these platforms help track billable hours, manage trust accounts, and keep finances in order.

Let’s break down the best accounting software options for small law firms and how they can help.

What is Law Firm Accounting Software?

Law firms don’t just need accounting software—they need tools built for the way legal finances work. Between managing trust accounts and staying compliant with industry regulations, standard bookkeeping software doesn’t always cut it.

Legal accounting software helps firms handle client funds properly, generate accurate invoices, and keep financial records organized without extra manual work. Many tools also integrate with case and law practice management software, making it easier to connect billing with legal work.

The key difference? It’s designed to keep law firms compliant and efficient. With built-in trust accounting, expense tracking, and reporting tools, it reduces the risk of errors and helps firms stay on top of their finances without getting lost in spreadsheets.

What Do Small Law Firms Have to Consider When Choosing Accounting Software?

Small law firms have different accounting needs than large firms. You don’t have a full finance team handling the books, so the software you choose has to be practical, compliant, and easy to use. Here’s what to consider:

- Trust accounting compliance – You’re responsible for client funds, and trust accounting mistakes can lead to serious issues. The software should properly track, separate, and reconcile trust accounts.

- Billing & invoicing – If your system doesn’t make it easy to log billable hours and send invoices, you could be leaving money on the table. Look for automated invoicing and payment tracking.

- Cost & scalability – Budgets are tight, and you don’t want to overpay for features you won’t use. But as your firm grows, you’ll need software that can keep up.

- Integration with legal tools – If your accounting software doesn’t sync with your case management system, you’ll spend extra time on manual data entry.

- User-friendliness – You don’t have time to struggle with complex software. A clean, intuitive interface is key.

- Reliable support – When problems arise, fast and knowledgeable customer service makes all the difference.

What Are The Biggest Benefits of Using Legal Accounting Software?

Do you ever feel like managing your firm’s finances takes up more time than actual legal work? Tracking billable hours, handling trust accounts, and chasing down invoices can be overwhelming—especially if you’re relying on spreadsheets or generic accounting tools.

The right legal accounting software keeps everything in check and helps your firm run more smoothly. Here’s how:

Trust Accounting Without the Headaches

Handling client trust accounts isn’t just another task on your to-do list—it’s a responsibility you can’t afford to get wrong. A single mistake can lead to compliance issues, penalties, or even worse.

A good legal accounting software solution takes the guesswork out of trust accounting by automatically keeping client funds separate, tracking every transaction, and generating audit-ready reports.

This means no more manual spreadsheets or worrying about whether your records are accurate. With clear trust ledgers and built-in safeguards, you can stay compliant and focus on your legal work instead of stressing over financial details.

Easier Billing and Faster Payments

Getting paid shouldn’t be a struggle. If you’re still manually tracking hours, creating invoices from scratch, and following up on late payments, you’re spending way too much time on admin work.

Legal accounting software makes billing easier by:

- Automatically logging billable hours

- Generating invoices

- Sending payment reminders

Clients can pay online without hassle, and this means fewer delays and keeping your cash flow steady. Instead of chasing payments or dealing with messy records, you’ll have a system that keeps everything organized.

Fewer Manual Errors

Ever caught a mistake in your books and thought, How did that even happen?

Maybe a decimal was off, a duplicate entry slipped in, or a trust account transaction didn’t balance. Manual data entry makes errors almost inevitable—and fixing them takes time you don’t have.

Legal accounting software helps prevent these slip-ups by automating calculations, tracking every transaction, and flagging inconsistencies before they turn into real problems. So, instead of double-checking numbers and fixing avoidable mistakes, you get clean, accurate records from the start.

Better Cash Flow Management

Late payments and untracked expenses can throw off your firm’s finances fast. If cash flow is unpredictable, it’s harder to plan for growth, cover expenses, or even pay yourself consistently.

The right legal billing software gives you real-time visibility into where your money is coming from—and where it’s going—so you can stay ahead of financial issues before they become bigger problems.

Here’s how it helps:

- Track unpaid invoices – See outstanding balances at a glance and send automated reminders to speed up payments.

- Monitor firm expenses – Keep an eye on operational costs so nothing eats into your profits unnoticed.

- Plan ahead with better forecasting – With real-time financial data, you can make informed decisions about hiring, investments, and budgeting.

- Avoid cash flow surprises – No more guessing whether your firm’s financial performance is enough to cover upcoming expenses.

Seamless Integration with Case Management

Tired of entering the same data twice? Manually linking invoices to cases? Jumping between systems just to get a clear financial picture? That’s the problem when accounting and case management don’t work together.

Good legal accounting software connects with your case management system and keeps financial records aligned with client work automatically. No more double data entry, missing transactions, or wasted time fixing errors.

With everything in sync, billing runs smoother, financial reporting capabilities improve, and client management stays organized. Rather than wrestling with spreadsheets, you get a clear, accurate view of your firm’s finances—without the extra hassle.

Less Time Spent on Admin Work

Nobody starts a law firm because they love bookkeeping. But if you’re spending more time tracking expenses and preparing tax reports than actually practicing law, something’s got to change.

Legal accounting software takes those tedious tasks off your plate. It automatically tracks expenses, syncs with your bank for easy reconciliations, and organizes tax records without the last-minute scramble (and that’s just the tip of the iceberg).

Instead of drowning in spreadsheets or trying to fix accounting mistakes at the end of the month, you can focus on your clients and casework.

Best Accounting Software For Small Law Firm Operations

Now that we’ve covered the key benefits, it’s time to look at the best options. Not all accounting tools are designed for law firms, and choosing the wrong one can lead to compliance issues and extra admin work.

Let’s break down the top accounting software for small law firms and what makes them worth considering.

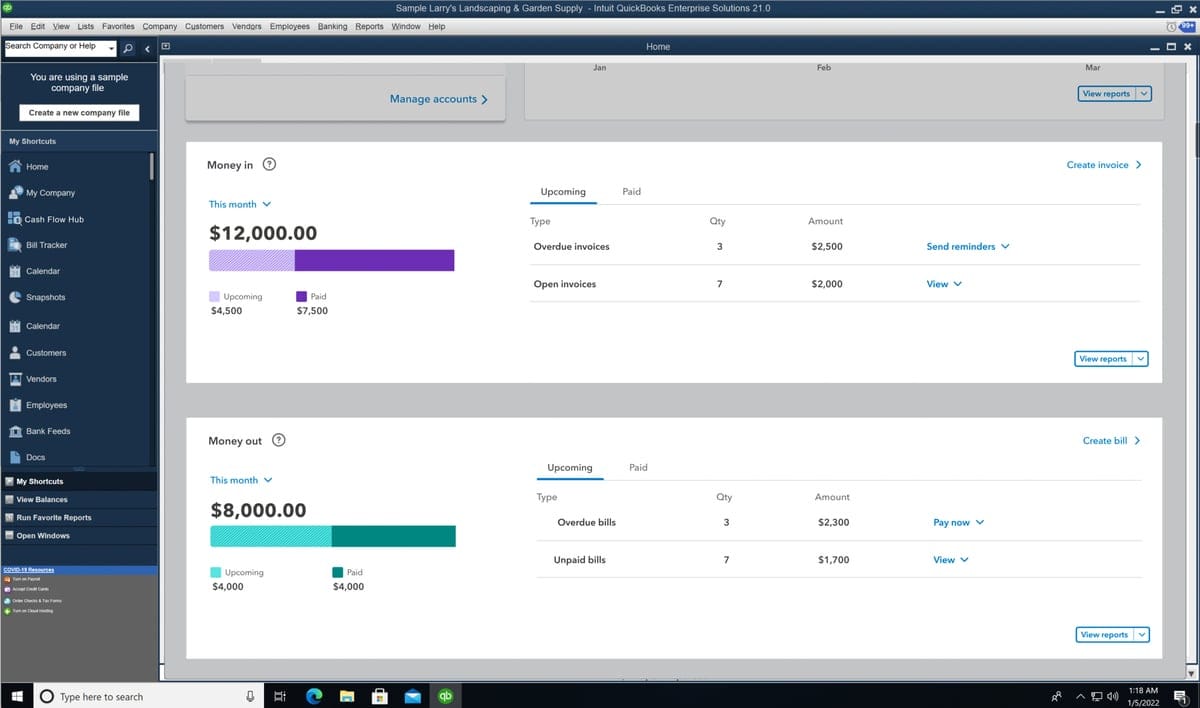

1. QuickBooks

QuickBooks is one of the most widely used accounting tools for small businesses, and law firms are no exception. With options like QuickBooks Online, QuickBooks Desktop, and QuickBooks Desktop Pro, firms can choose a plan that fits their needs.

Source: G2

While it’s not built specifically for legal professionals, it offers powerful financial management features and integrates with legal software like Clio and LeanLaw.

Whether you need cloud-based access, advanced reporting, or simple bookkeeping, QuickBooks has a version that can handle your firm’s accounting needs.

Best Features

- Customizable invoicing: Create and send professional invoices, track payments, and accept online payments.

- Expense tracking: Automatically categorize expenses and reconcile bank transactions.

- Trust accounting support: Integrate with LeanLaw or Clio to properly manage client trust funds.

- Financial reporting: Generate profit and loss statements, balance sheets, and tax reports.

- Legal software integration: Sync with Clio, LeanLaw, and other law firm tools for seamless accounting.

Pros

- Easy to use and widely recognized

- Strong reporting and financial tracking

- Syncs with banks, payroll, and law firm tools

- Multiple versions available for different business needs

- Cloud-based access for remote accounting

- Scalable plans for growing firms

Pricing

The starting price for QuickBooks is €9.50 for the Simple Start plan. It comes with basic accounting essentials, such as invoices, receipt capture, income and expenses, and more. For teams, the Essentials Plan starts at €13.50, coming with more features and three user spots.

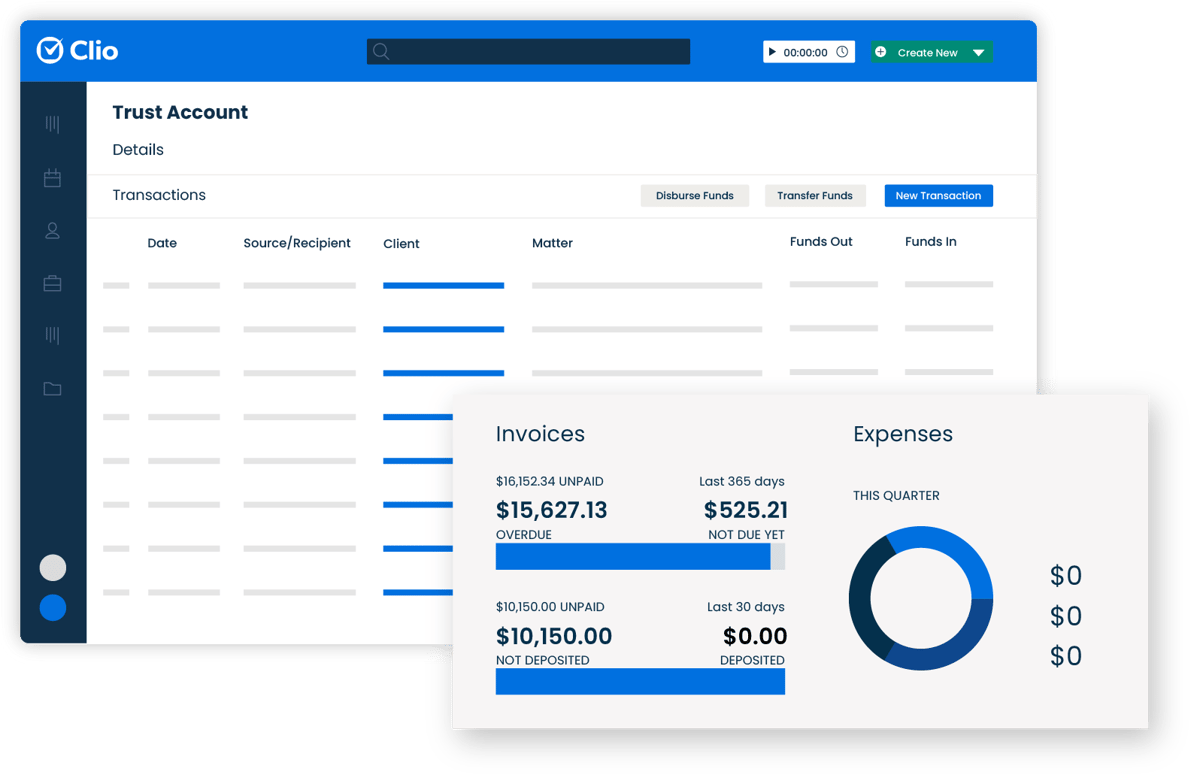

2. Clio Accounting

Clio Accounting is designed specifically for law firms, which makes it easier to manage trust accounting, billing, and financial reporting while staying compliant.

Source: G2

As part of the Clio ecosystem, it integrates with Clio Manage, allowing firms to track billable hours, generate invoices, and handle trust accounts all in one place.

Unlike general accounting software, Clio Accounting is built with legal professionals in mind. This can help reduce the risk of compliance issues and manual errors.

Best Features

- Trust accounting compliance: Keeps client funds separate and generates reports to meet legal industry regulations.

- Automated invoicing: Create and send professional invoices with built-in time tracking.

- Payment processing: Accept online payments through Clio Payments, reducing delays.

- Expense tracking: Log and categorize firm and client expenses effortlessly.

- Easy integration with Clio Manage: Syncs billing and accounting data with your case management system.

Pros

- Built specifically for law firms

- Strong trust accounting features

- Fully integrates with Clio’s legal management tools

- Cloud-based access for anytime, anywhere financial management

- Automated reminders help reduce late payments

- Reduces manual data entry by syncing with case files

Pricing

Clio Accounting is an optional add-on, available for the Essentials Plan and up. The starting price for the Essentials Plan is $89 per user per month.

3. LeanLaw

LeanLaw is built specifically for law firms that want seamless integration with QuickBooks while maintaining compliance with legal accounting rules.

Source: LeanLaw.co

It simplifies trust accounting, time tracking, and billing, making it a great choice for firms that rely on QuickBooks but need legal-specific features. With an easy-to-use interface and strong financial reporting, LeanLaw helps small law firms manage their books without extra complexity.

Best Features

- Deep QuickBooks integration: Syncs directly with QuickBooks Online for smooth accounting workflows.

- Trust accounting compliance: Helps keep client funds separate and generates audit-ready reports.

- Time tracking & invoicing: Logs billable hours and turns them into invoices with a single click.

- LEDES billing support: Exports invoices in LEDES format for firms working with corporate clients.

- Expense tracking: Categorizes and assigns firm and client-related expenses easily.

Pros

- Designed specifically for law firms

- One of the best QuickBooks integrations available

- Simple and intuitive interface

- Helps prevent trust accounting errors

- Customizable reports for better financial insights

- Reduces manual data entry for time tracking and billing

Pricing

LeanLaw’s pricing starts at $45 per user per month for the Core Plan, which comes with features like time tracking, electronic payments, and invoicing.

4. FreshBooks

FreshBooks is a simple and user-friendly accounting solution for solo attorneys and small law firms that need straightforward invoicing, expense tracking, and timekeeping.

Source: G2

Although it’s not built specifically for law firms, its easy-to-use interface and automation features make financial management less time-consuming. It’s a good option for firms that don’t require complex trust accounting but need an efficient way to handle billing and expenses.

Best Features

- Automated invoicing: Create, send, and track invoices with built-in reminders for late payments.

- Time tracking: Log billable hours and convert them into invoices with one click.

- Expense management: Automatically track and categorize expenses for easier reporting.

- Online payments: Accept credit card and ACH payments directly through FreshBooks.

- Financial reporting: Generate profit and loss statements, expense summaries, and tax reports.

Pros

- Clean, easy-to-use interface

- Great for solo attorneys and small firms

- Automates invoicing and payment reminders

- Mobile-friendly for on-the-go access

- Affordable pricing compared to other options

Pricing

Plans start at $6.30 for the Lite plan, which allows users to send invoices to five clients, track expenses and other basic accounting work. More robust features are available in higher-tier plans, starting at $11.40 per month for the Plus plan.

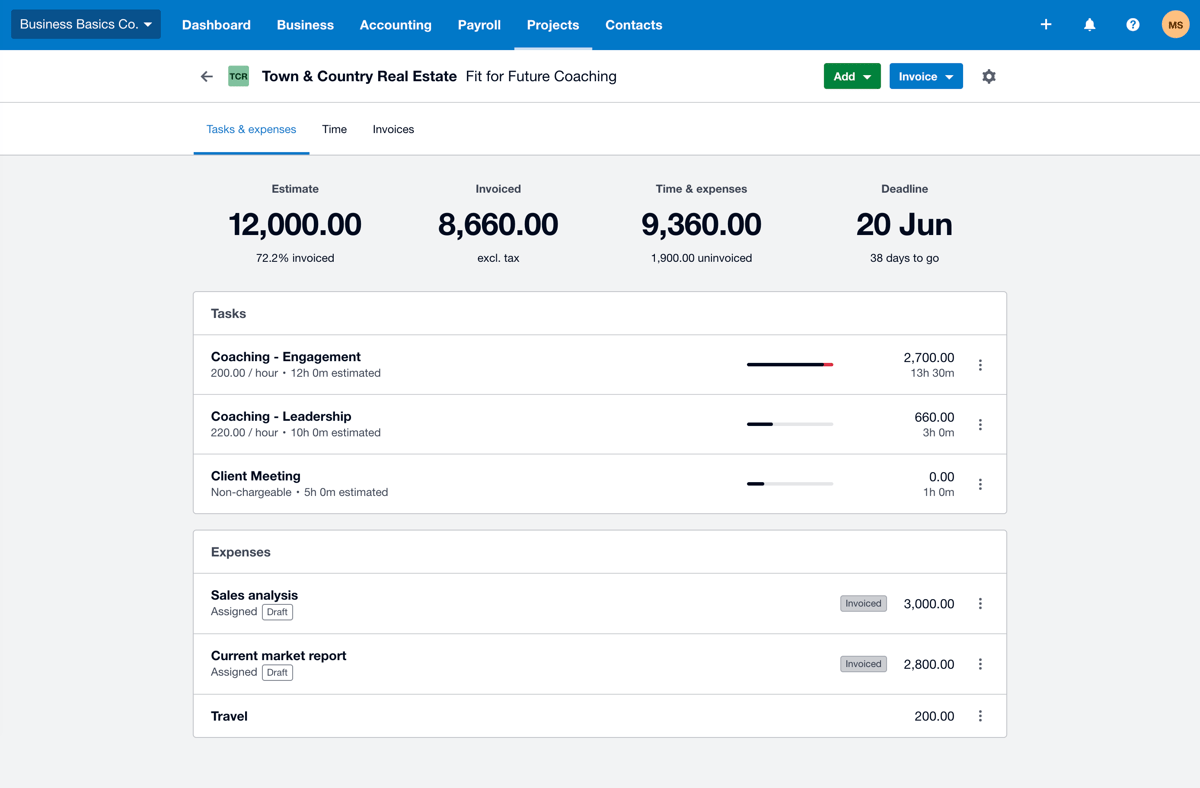

5. Xero

Xero is designed for small businesses but offers key features that work well for law firms, including automated bank reconciliation, invoicing, and expense tracking.

Source: G2

With real-time financial insights and multi-user access, Xero helps firms stay on top of cash flow without getting bogged down in spreadsheets. Plus, it integrates with legal practice management tools, which makes it easier to keep billing and accounting connected.

Best Features

- Bank reconciliation: Syncs with your bank to automatically track and match transactions.

- Customizable invoicing: Create and send branded invoices with automated payment reminders.

- Expense tracking: Categorizes and manages firm-related expenses for better financial oversight.

- Multi-user access: Allows accountants, bookkeepers, and partners to collaborate in real time.

- Financial reporting: Provides insights into cash flow, outstanding invoices, and overall firm performance.

Pros

- Affordable compared to other accounting tools

- Cloud-based for easy access from any device

- Integrates with legal management software like Clio

- User-friendly dashboard with real-time financial insights

- Strong security features to protect financial data

- Scalable for growing firms

Pricing

Xero’s Starter Plan costs $29 per month, which lets users send quotes and up to 20 invoices, enter five bills, reconcile bank transactions, and record bills and receipts.

Want to Beef Up Your Law Firm’s Cash Flow? Try Briefpoint

Keeping your firm’s finances in order isn’t just about choosing the right accounting software—it’s also about making the most of your time. Even the best accounting tools can’t fix cash flow problems caused by hours of unpaid admin work.

Briefpoint helps by automating legal drafting and generating discovery documents in minutes. This way, you can cut down the time spent on repetitive tasks and actually focus on billable work.

More billable hours mean more money in your bank accounts and keeping your firm financially stable. Instead of getting buried in paperwork, you’ll spend more time on high-value tasks that bring in revenue.

Want to see how much time—and money—you could be saving? Book your Briefpoint demo today.

Save Thousands Every Year With Briefpoint

Discovery responses cost firms $23,240, per year, per attorney. $23,240 estimate assumes an associate attorney salary of $150,000 (including benefits – or $83 an hour), 20 cases per year/per associate, 4 discovery sets per case, 30 questions per set, 3.5 hours spent responding to each set, and 1800 hours of billable hours per year.

Book a demo and save on these costs with Briefpoint.

FAQs About Accounting Software For Small Law Firms

What software do most law firms use?

Most law firms use a combination of legal-specific software for case management, billing, and accounting. Popular choices include Clio, LeanLaw, and QuickBooks (with legal integrations). Firms looking for a robust accounting platform often choose tools that offer trust accounting, invoicing, and financial reporting designed for legal compliance.

Does QuickBooks work for law firms?

Yes, but it requires legal-specific integrations to handle trust accounting properly. Many firms pair QuickBooks Online with tools like LeanLaw or Clio to ensure compliance with legal financial regulations.

What is CRM for law firms?

A law firm CRM (customer relationship management) system helps track client interactions, manage leads, and improve client communication. Unlike case management software, a CRM focuses on business development and client retention rather than legal workflows.

How much does law firm software cost?

Prices vary depending on the type of software and features included. Basic accounting tools like Xero start at $29 per month, while comprehensive legal platforms like QuickBooks and LeanLaw range from $35 to $45 per user per month. Advanced solutions with CRM and case management features can cost significantly more.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information. This website contains links to other third-party websites. Such links are only for the convenience of the reader, user or browser. Readers of this website should contact their attorney to obtain advice with respect to any particular legal matter. No reader, user, or browser of this site should act or refrain from acting on the basis of information on this site without first seeking legal advice from counsel in the relevant jurisdiction. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client relationship between the reader, user, or browser and website authors, contributors, contributing law firms, or committee members and their respective employers.