Legal Billing Software: What You Need to Know (+ 7 Best Options)

Legal Billing Software: What You Need to Know (+ 7 Best Options)

Managing billing at a law firm can be tricky. With multiple clients, trust accounts, and countless billable hours to track, it’s easy to feel overwhelmed. And the truth for most of the legal industry: Managing invoices and payments manually isn’t just time-consuming; it’s a recipe for errors and delays.

Legal billing software is specifically designed to simplify these challenges. It handles everything from tracking time to managing payments so you can stay organized and avoid mistakes.

In this guide, we’ll break down what legal billing software is, why it’s different from regular accounting tools, and how it can benefit your firm. Plus, we’ve rounded up seven top options to help you find the best fit for your practice!

What Is Legal Billing Software?

Legal billing software is made specifically for law firms to handle billing, payments, and trust accounts. It helps track billable hours, send out invoices, and manage payments without all the hassle.

Unlike regular accounting software, it’s built with law firms in mind, including features to keep things compliant and organized.

Here’s what it can do:

- Makes it easy to log billable hours

- Generate clear, professional bills for clients

- Keep client funds properly organized

- Check payments, balances, and expenses with a few clicks

- Works with case management systems to save time

In short, legal billing software helps you stay on top of your billing, avoid errors, and spend more time focusing on your clients.

How Does It Differ From Regular Accounting Software?

Legal billing software is tailored specifically to the unique needs of law firms, while regular accounting software is more general and designed for businesses across various industries.

One major difference is time tracking. Legal billing software lets you track billable and non-billable hours accurately, which helps make sure your invoices reflect the work done for each client—something standard accounting software typically doesn’t offer.

Another key feature is trust accounting, which is critical for law firms to manage client trust funds and comply with legal regulations. Generic accounting tools aren’t equipped to handle this.

Additionally, legal billing software provides specialized reports, such as case-specific cost breakdowns and client expense summaries, which go beyond the standard financial reports found in regular tools.

Many legal billing platforms also integrate with case management systems to organize workflows in a way that generic software often can’t. These differences make legal billing software a much better choice for law firms.

Why Do Law Firms Need Legal Billing Software?

Legal billing software isn’t just convenient—it’s essential for law firms aiming to stay organized, save time, and improve accuracy. Here’s why it’s worth the investment:

Accurate Billing

Tracking every billable minute manually can be a real headache. It’s easy to miss a few minutes here and there, and those small errors can add up to big losses over time. Plus, mistakes in the legal billing process can lead to client disputes, which no one wants to deal with.

Legal billing software takes the kinks out of the process. It tracks your time automatically, so you know exactly how many hours you’ve worked and can create accurate, detailed invoices.

Clients appreciate clear, transparent billing, and you’ll avoid awkward conversations about charges that don’t add up. On top of that, you’ll get paid for every minute of the work you’ve done.

Time Savings

Creating invoices and tracking payments manually can take up hours you could spend on client cases or other important work. Legal billing software simplifies these tasks by automating time tracking, invoice generation, and payment reminders, making the process much quicker and easier.

With everything handled in just a few clicks, you save countless hours that would’ve been spent on repetitive administrative work. Automation also helps reduce errors, so you’re not stuck fixing mistakes later.

By freeing up your schedule, legal billing software lets you focus on your clients and their cases without getting bogged down by tedious billing tasks.

Better Cash Flow

Legal billing software improves cash flow by taking the hassle out of getting paid. Here’s how it helps:

- Automated reminders: The software sends reminders to clients automatically, which helps reduce delays.

- Online payment options: Clients can pay instantly through secure online portals, making the process faster and more convenient.

- Fewer overdue invoices: With clear invoices and easy payment methods, clients are less likely to miss deadlines.

By combining these features, legal billing software keeps the payments coming in on time, so your firm runs smoothly without the stress of unpaid bills.

Trust Account Management

Managing client trust funds comes with a lot of responsibility, and even small mistakes can lead to serious issues. Legal billing software makes trust account management much simpler by organizing funds and making sure everything stays compliant with legal standards.

It tracks deposits and withdrawals accurately, so you always know where client funds stand. Many tools also include built-in safeguards to prevent errors, such as mixing trust funds with operating funds. This helps maintain compliance and gives you peace of mind knowing everything is handled properly.

Detailed Reporting

Legal billing software takes the guesswork out of understanding your firm’s financial health by providing detailed reports. These reports give you a clear breakdown of case expenses, client payments, and outstanding balances, all in one place. Instead of sifting through spreadsheets or scattered data, you can access organized insights with just a few clicks.

Whether you’re checking which clients have unpaid invoices, analyzing case profitability, or planning budgets, these reports make it easy to see where things stand. The ability to quickly pull up accurate financial information saves time and helps you make better decisions for your firm.

Our Top 7 Picks for Legal Billing Software

Choosing the right legal billing software can make a big difference in how efficiently your firm operates. With so many options available, it’s important to find a tool that fits your specific needs. Below, we’ve highlighted some of the best legal billing software options.

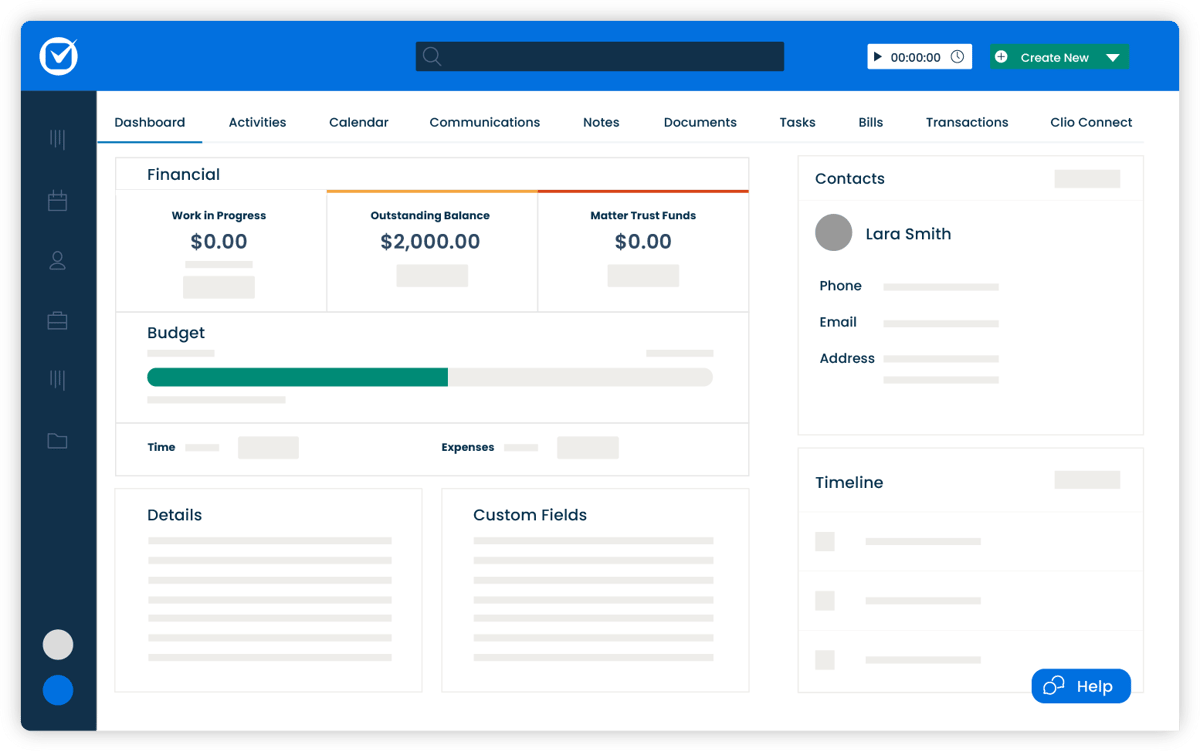

1. Clio

Clio is a versatile legal practice management platform that offers tools for case management, document organization, client communication, and more.

While it’s not primarily a billing software, Clio includes great billing features designed to simplify invoicing, time tracking, and trust account management.

Source: G2

Key Features

- Time tracking and billing: Track billable hours precisely and generate detailed invoices tailored to your clients.

- Customizable invoice templates: Create professional, branded invoices that reflect your firm’s style and include all necessary details.

- Secure client portal: Provide clients a secure space to view invoices, share documents, and communicate directly with your firm.

- Trust accounting management: Keep client funds compliant and organized with tools to separate trust and operating accounts.

- Integration with popular tools: Sync with QuickBooks, Google Workspace, Zoom, and more to optimize your workflows.

Pros

- Easy to use, even for those new to legal billing software.

- Excellent customer support for troubleshooting and setup.

Cons

- Pricing can be high for smaller firms or solo practitioners.

- Advanced features may require a steeper learning curve.

Pricing

Clio offers plans starting at $49 per user per month which includes a basic legal billing system, as well as flexible payment options.

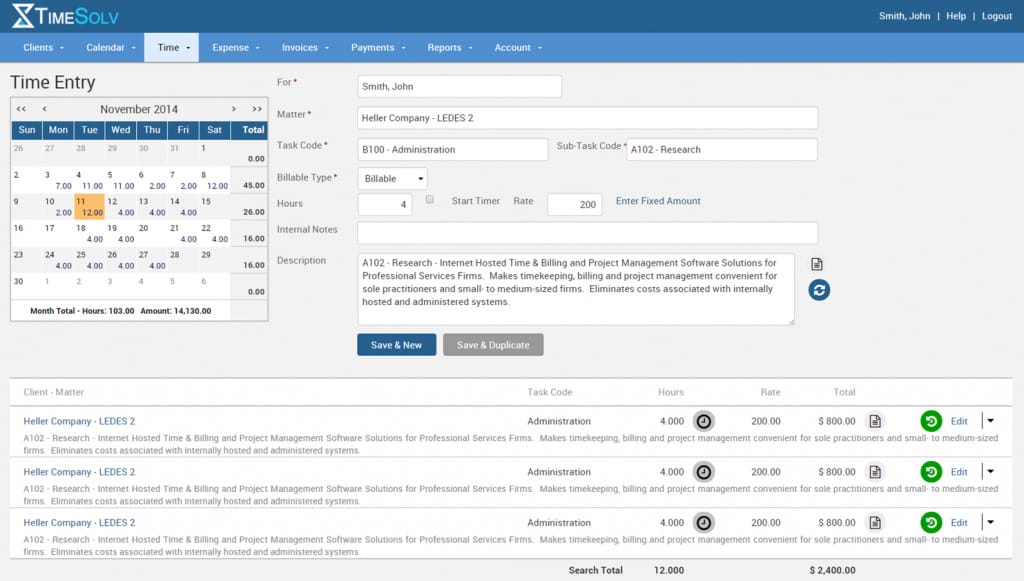

2. Timesolv

Timesolv is online legal billing software designed to help law firms easily manage their billing processes. This billing solution is particularly well-suited for smaller firms and solo practitioners as it balances affordability and functionality.

Source: G2

Key Features

- Cloud-based access: Work from anywhere with secure access to time tracking, billing, and client data, whether on a computer or mobile device.

- Advanced time tracking: Log billable and non-billable hours accurately with built-in timers and manual entry options.

- Split billing: Easily divide invoices between multiple clients or matters, making complex billing scenarios hassle-free.

- Trust accounting tools: Track client trust funds with tools to maintain compliance and keep funds organized separately from operating accounts.

- Detailed reporting: Generate reports on billing, payments, and firm performance to get a clear picture of your financial health.

Pros

- Affordable for smaller firms and solo attorneys.

- Offers strong data security features.

Cons

- Limited customization options for invoices.

- Can feel basic for larger firms needing advanced features.

Pricing

Timesolv’s pricing starts at $49.99 for up to four users. The starting plan includes trust accounting, unlimited clients, and integration with other legal management software.

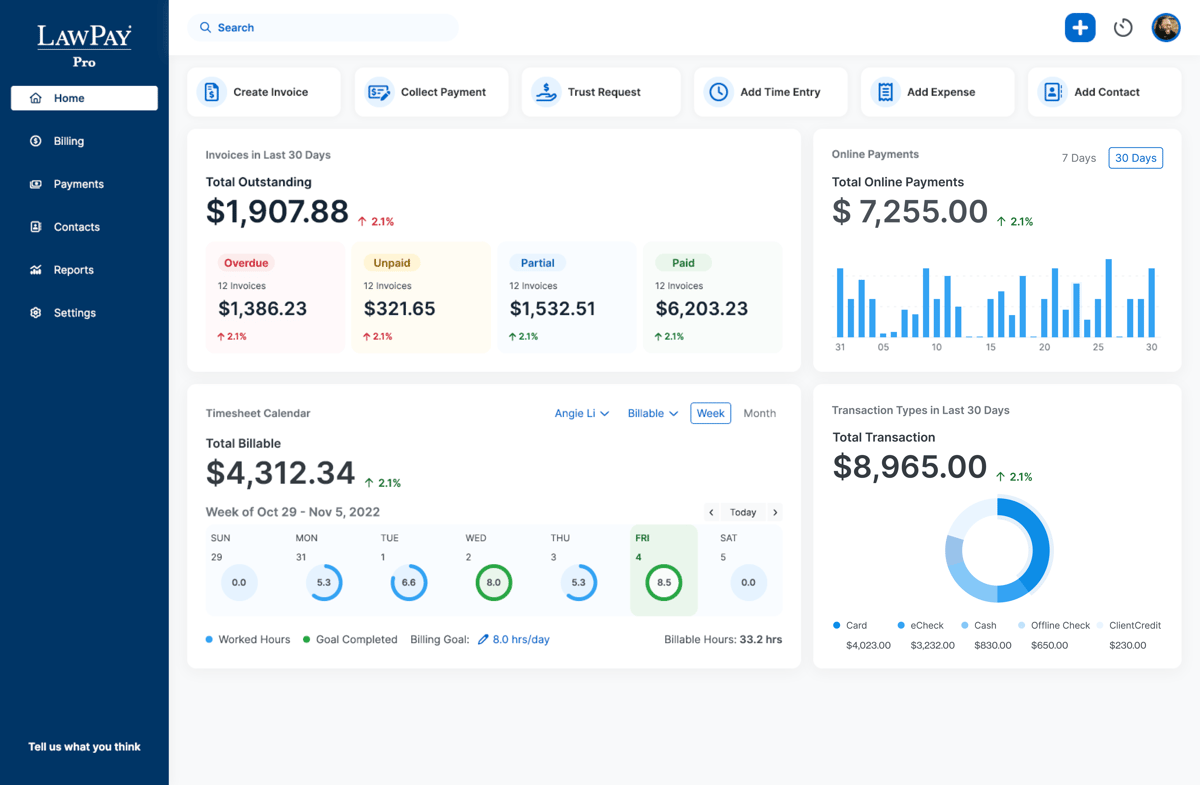

3. Lawpay

Lawpay is a payment processing solution built specifically for law firms and focuses on making transactions easy and compliant. It’s not complete legal office billing software, but it works seamlessly alongside your existing tools to simplify payment collection and trust accounting.

Source: G2

Key Features

- Secure payment processing: Accept credit card payments, ACH transfers, and eChecks, all while making sure client funds are handled securely.

- Trust account compliance: Automatically separates earned and unearned funds to help you meet trust accounting requirements without the risk of commingling.

- Customizable payment pages: Create branded payment pages for your website to provide a professional and convenient experience for clients.

- Recurring payment options: Set up recurring billing for ongoing matters, which reduces administrative tasks.

- Detailed transaction reporting: Track all payments and deposits in real time so it’s easier to manage finances and maintain accurate records.

Pros

- Simplifies trust accounting for compliance.

- Easy to set up and use for legal professionals.

Cons

- Limited features compared to all-in-one billing software.

- Pricing may feel high for firms looking for more comprehensive tools.

Pricing

Lawpay offers plans starting at $19 per month, including features like trust account protection, unlimited users, and customizable website payment pages.

4. Smokeball

Smokeball is a cloud-based legal practice management software that offers tools for billing, case management, and document automation. While it’s known for its comprehensive features, its billing functionality stands out with automatic time tracking and pre-built templates.

Source: G2

Key Features

- Automatic time tracking: Captures all billable and non-billable hours without requiring manual input.

- Pre-built invoice templates: Create detailed and professional invoices quickly, with options to include time entries, expenses, and case-specific details.

- Case and matter management: Organize all case-related files, deadlines, and communications in one centralized platform.

- Document automation: Generate legal documents quickly with pre-built templates tailored for various practice areas.

- Trust accounting management: Easily handle client trust funds with tools designed to ensure compliance and accuracy.

Pros

- Great for small teams needing simple but powerful tools.

- Intuitive interface that’s easy to navigate.

Cons

- Lacks advanced reporting features found in larger platforms.

- Pricing can be steep for firms with limited budgets.

Pricing

Smokeball’s pricing is not currently publicly available.

5. FreshBooks

FreshBooks is a popular accounting and invoicing platform ideal for solo attorneys and small law firms.

It’s not designed exclusively for legal professionals, but its intuitive interface and billing features make it a great option for those who need simple, straightforward tools for managing invoices, payments, and expenses.

Source: G2

Key Features

- Expense tracking: Easily log and categorize firm expenses to keep your finances organized and track costs against budgets.

- Automated invoice reminders: Sends friendly reminders to clients automatically to help you get timely payments without the need for manual follow-ups.

- Multi-currency and multi-language support: Perfect for firms with international clients as it offers flexibility in billing for different currencies and languages.

- Online payment options: Accept payments via credit cards, ACH transfers, or payment gateways, which makes it easy and convenient for clients to pay invoices.

- Detailed financial reporting: Provides insights into income, expenses, profit margins, and outstanding balances.

Pros

- Easy to use, even for those without accounting experience.

- Affordable pricing plans for solo practitioners.

Cons

- Limited legal-specific features compared to dedicated legal billing tools.

- Trust account management requires additional setup.

Pricing

FreshBooks starts at $4.75 per month, offering a budget-friendly solution for small firms or solo attorneys looking for essential billing and invoicing features like expense tracking and invoices. For more advanced features, the Premium plan starts at $15 per month.

6. PointOne

PointOne is an AI-driven platform that automates timekeeping and billing for law firms. Its goal is to optimize efficiency and profitability by reducing administrative burdens and ensuring accurate time capture.

Source: Pointone.com

Key Features

- Automated time tracking: PointOne passively records all work activities, capturing billable time without manual input, which helps reduce administrative tasks.

- AI-powered pre-bill review: The platform uses artificial intelligence to review pre-bills, suggesting edits to improve bill quality and compliance with client guidelines.

- Integration: PointOne integrates with existing billing software and practice management systems.

- Real-time collaboration: The platform offers features that allow team members to collaborate on billing matters for better alignment and transparency within the firm.

Pros

- Automates time capture, ensuring all billable activities are recorded.

- AI-driven reviews help produce precise and compliant bills, reducing errors and disputes.

- Frees up time by automating timekeeping and billing processes, boosting productivity.

Cons

- Implementing new AI-driven tools may require an adjustment period for staff.

- Integration compatibility may vary with some existing firm software.

Pricing

PointOne currently does not have its pricing publicly listed.

7. Ajax

Ajax is AI-powered timekeeping software designed to automate time tracking for legal professionals. It runs quietly in the background and captures all work activities. The platform generates accurate timesheets with detailed narratives, which helps lawyers focus more on their practice and less on administrative tasks.

Source: Joinajax.com

Key Features

- Automated time tracking: Ajax passively records all work activities, including brief tasks that are often overlooked.

- Detailed timesheet generation: The software creates precise timesheets with narratives, matching recorded activities to the relevant client matters, which improves billing accuracy.

- Integration: Ajax integrates with popular practice management and billing systems to organize workflows and reduce the need for multiple platforms.

- User-friendly interface: Designed with simplicity in mind, Ajax offers an intuitive user experience, making it easy for legal professionals to adopt and utilize effectively.

Pros

- Tracks every task accurately, even small ones often overlooked.

- Generates detailed, client-friendly timesheets.

- Saves time by automating repetitive timekeeping tasks.

Cons

- Integration options are limited with certain third-party tools.

- Requires a learning period to understand all features fully.

Pricing

Ajax currently doesn’t offer public pricing information.

Automate Parts of Your Discovery Process With Briefpoint

Legal billing software handles invoicing and payments, but Briefpoint goes beyond that by tackling one of the most time-intensive tasks for law firms: discovery responses.

Managing discovery work often requires answering dozens of questions for every case across multiple discovery sets. It’s a tedious process that eats into your team’s valuable time and resources.

Briefpoint automates much of this work, simplifying the process and reducing the manual effort involved. With fewer hours spent on repetitive tasks, your team can focus on higher-value activities that truly impact your clients and cases.

Want to see how it works? Schedule a demo here and discover how Briefpoint can help your firm work smarter.

Take Care of Your Law Firm Finances With Briefpoint

Discovery responses cost firms $23,240, per year, per attorney. $23,240 estimate assumes an associate attorney salary of $150,000 (including benefits – or $83 an hour), 20 cases per year/per associate, 4 discovery sets per case, 30 questions per set, 3.5 hours spent responding to each set, and 1800 hours of billable hours per year.

Book a demo and save on these costs with Briefpoint.

FAQs About Legal Billing Software

How much does legal billing software cost?

The cost of legal billing software varies depending on the features and size of your firm. Prices typically start around $15 to $40 per user per month for basic plans, with more advanced options costing more.

What is legal billing software?

Dedicated legal billing software is a specialized tool designed to help law firms track billable hours, create invoices, accept online payments, and manage trust accounts. It’s tailored to meet the unique needs of legal professionals, ensuring compliance with industry standards.

What software do most law firms use?

Popular options for law firms include Clio, Timesolv, Lawpay, Smokeball, and FreshBooks. These tools are widely used because they offer features like time tracking, invoicing, and trust accounting, all essential for running a law practice smoothly.

What is considered legal billing?

Legal billing refers to the process of tracking billable hours, expenses, and payments for legal services provided to clients. It includes generating invoices, managing trust accounts, and ensuring accurate payment collection for the work performed.

How can legal professionals manage invoicing more efficiently?

Legal professionals can manage invoicing more efficiently by using legal billing software. These tools automate time tracking, invoice creation, and payment reminders, ensuring that invoices are accurate and sent on time. Features like customizable templates and detailed reporting also make it easier to handle client billing with less effort.

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information.

This website contains links to other third-party websites. Such links are only for the convenience of the reader, user or browser. Readers of this website should contact their attorney to obtain advice with respect to any particular legal matter. No reader, user, or browser of this site should act or refrain from acting on the basis of information on this site without first seeking legal advice from counsel in the relevant jurisdiction. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client relationship between the reader, user, or browser and website authors, contributors, contributing law firms, or committee members and their respective employers.